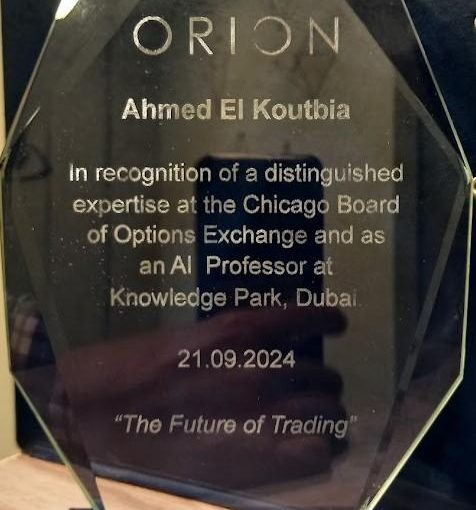

On September 21, 2024, I had the privilege of speaking at an international algorithmic trading conference in Madrid, Spain. I was honored to receive an award for my contributions, and in this article, I’ll share insights on building automated trading systems, drawing from my experience in developing cryptocurrency futures trading systems and my recent talk.

Motivation Behind Building Automated Trading Systems

In today’s fast-paced financial markets, speed, accuracy, and scalability are crucial to success. This is where automated trading systems offer a significant edge over traditional manual methods. Here’s why they’re essential for modern traders:

- Elimination of Human Error and Emotion

Manual trading is often influenced by emotions like fear or greed, which can lead to costly mistakes. Automated systems execute trades based solely on predefined algorithms, ensuring precision and consistency. - 24/7 Availability

Markets like cryptocurrency operate 24/7, and it’s impractical for human traders to monitor them constantly. Automated systems, however, can operate around the clock, seizing opportunities even during off-hours. - Processing Large Amounts of Data

Automated systems can analyze vast amounts of financial data in milliseconds, identifying trends and executing trades faster than any human could. This speed gives traders a competitive edge. - Leveraging Advanced AI for Prediction

With the integration of AI and machine learning, automated systems are becoming smarter. They can analyze historical and real-time data, predict trends, and optimize strategies over time.

Steps to Building an Automated Trading System

With a clear understanding of the motivations behind automated trading systems, let’s explore the key steps in building one. At the core of any trading algorithm is data—both historical and real-time market data. Efficiently collecting, managing, and analyzing this data is essential for creating a system that generates and executes profitable trades.

1. Data Scraping and Handling Large Data Streams

Efficient data collection is critical for strategy development and real-time decision-making. Depending on the assets traded, brokers and exchanges often provide free access to both historical and live data. For example, cryptocurrency exchanges often offer APIs that supply detailed trade data, sometimes down to the millisecond. By leveraging this data, you can build custom candlesticks (e.g., 1-minute, 1-hour) to reduce reliance on frequent API calls and avoid rate limits.

- RESTful APIs for Historical Data: RESTful APIs provide access to historical price movements, trading volumes, and other key metrics. This data is essential for backtesting strategies, offering insights into how your algorithm would have performed under past market conditions.

- WebSockets for Live Trade Data: WebSockets enable real-time data streams, allowing your system to react instantly to market fluctuations. This capability is especially crucial for high-frequency trading.

Developing and Backtesting a Trading Strategy

With data collection in place, the next crucial step is designing a trading strategy and rigorously testing it through backtesting.

1. What is a Trading Strategy?

A trading strategy is a set of predefined rules that determine when to buy or sell financial instruments. The key components of any strategy include:

- Entry Rules: Signals dictating when to open a trade, such as price movements or market trends.

- Exit Rules: Guidelines for closing a trade, either to take profits or limit losses.

- Risk Management: Risk controls that limit exposure to large losses, including stop-loss levels and capital allocation per trade.

2. What is Backtesting?

Backtesting applies a trading strategy to historical data to evaluate its past performance. It helps you determine how the strategy might perform under real-world conditions without risking capital.

Key Benefit: Backtesting gives traders the confidence to optimize their strategies and assess their performance under different market conditions, making it an essential step before deploying strategies in live trading.

After backtesting, the next step is to fine-tune your strategy for optimal performance while avoiding common pitfalls like overfitting.

3. Fine-Tuning Strategies

Fine-tuning involves adjusting the parameters of a strategy to improve its performance. This might involve refining entry or exit signals or adjusting key indicators for different market conditions.

For example:

- A shorter Exponential Moving Average (EMA) might capture short-term price movements in volatile markets, while longer EMAs are better suited for identifying long-term trends.

4. Avoiding Overfitting

Overfitting happens when a strategy is too closely optimized to historical data, resulting in poor performance in live markets. To avoid this, test strategies on out-of-sample data (data not used in the original backtest) to ensure they perform well across different timeframes and market conditions.

Designing an Automated Trading System

A well-designed automated trading system is critical for long-term success. Here are the key design principles to consider:

- Flexibility and Modularity: A robust system should allow traders to test and switch between multiple strategies easily.

- Risk Management and Execution: Systems should handle asynchronous communication with brokers, enabling the use of limit orders to reduce transaction fees and ensure efficient execution.

- Security and Monitoring: Real-time monitoring and robust security measures, such as API key protection, are essential for safeguarding your operations and ensuring system uptime.

Cloud Deployment: Ensuring Availability and Reliability

Deploying an automated trading system on the cloud ensures high availability and reduces risks associated with local infrastructure. Running a system on a local server can lead to potential issues, such as internet interruptions or power failures, which can severely impact trading performance.

By deploying systems on cloud-based platforms like AWS or Google Cloud, you ensure 24/7 uptime, scalability, and robust failover mechanisms.

Leveraging AI in Automated Trading Systems

Artificial Intelligence (AI) has become a powerful tool in automated trading, enabling systems to make intelligent, adaptive decisions. Incorporating AI models alongside traditional trading indicators—such as technical and fundamental analysis—enhances the decision-making process. For example, if an AI model predicts that Bitcoin’s price will rise, this insight can complement traditional indicators, helping traders make more informed decisions.

Here’s how AI enhances trading strategies:

- Price Prediction with Regression Models: AI uses historical data to predict price trends, providing traders with actionable insights on when to enter or exit trades.

- Trend Prediction with Classification Models: Classification models predict bullish or bearish trends, allowing traders to align their strategies accordingly.

- Reinforcement Learning for Trade Optimization: Reinforcement learning enables continuous improvement by analyzing past trades and making smarter decisions over time.

Conclusion: Embracing the Future of Trading

Building an automated trading system is no longer just a competitive advantage—it’s a necessity for traders who want to stay ahead. From eliminating human error to leveraging AI, automated systems allow traders to operate more efficiently, process large volumes of data, and make smarter, data-driven decisions.

Ready to Take the Next Step?

Building an effective automated trading system requires a solid foundation in data analysis, strategy development, and AI integration. If you’re ready to elevate your skills, our Algorithmic Trading and Financial Data Analysis program offers an interactive, hands-on learning experience covering all the essential concepts.

In this program, you’ll learn how to:

- Collect and analyze historical financial data

- Develop profitable trading strategies

- Backtest and optimize your strategies for real-world conditions

- Design, build, and deploy automated trading systems

- Use machine learning models for price and trend predictions

- Seamlessly connect and trade through broker APIs

- Analyze real-time order book data for informed trading decisions

This is your opportunity to master cutting-edge financial technologies and gain the practical skills needed to succeed in today’s fast-moving markets.

Learn more and enroll here: Python for Financial Data Analysis and Algorithmic Trading